Gold at lowest level since May 2012. Is this the bottom of this cycle?

|

Week ending 22nd February 2013 ($USD) |

Gold |

Silver |

|

Close this week |

Gold & Silver break through technical support to reach 6 month low.

|

Week ending 15th February 2013 ($USD) |

Gold |

Silver |

|

Close this week |

$1,612.25 |

$30.18 |

Gold & Silver range trading. Aussie $ falls 1.2%+ for the week.

|

Week ending 8th February 2013 ($USD) |

Gold |

Silver |

|

Close this week |

$1,668.25 |

$31.52 |

Gold and Silver closed the week higher after peaking mid week, while equity markets continue to perform well.

|

Week ending 1st February 2013 ($USD) |

Gold |

Silver |

|

Close this week |

$1,669.00 |

$31.43 |

Gold and Silver closed lower for the week with continuing short term pressure while some announcements confirm strong medium term prospects.

|

Week ending 25th January 2013 |

Gold |

Silver |

|

Close previous week |

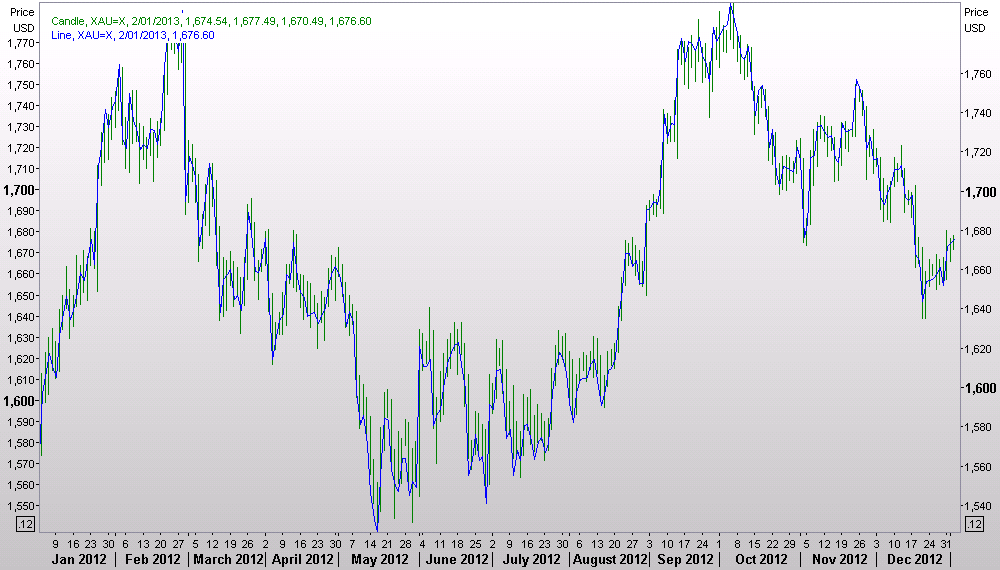

Gold has ended the year 5.2% up for the 2012 year in AUD terms (and 6.9% up in USD terms). Importantly Gold chalked up its 12th annual advance, the longest consecutive gain of any commodity.

2012 has been an up and down year, more down in the last 3 months end of year profit-taking and an uncertain period in relation to the US fiscal cliff. The following chart summarises the year:

Fiscal Cliff resolved?

Dear Friend/ Member,

The team at AusMint wishes you and your family a very merry Christmas and a safe and prosperous New Year!

We thank you for the opportunity to service your precious metals needs during 2012 and look forward to assisting you where possible into 2013.

Dear Friend/ Member,

Gold prices have fallen almost 3% over the last 2 weeks, settling this morning at around US$1,700 and AU$1,620 per ounce.

It seems that much of this has been driven by the continuing stalemate over the USA budget deal needed to avoid the US$600 billion 'fiscal clifff'. The 1st January deadline is fast looming and reports are that most of the selling has been institutional investors lightening their gold holdings.

In the backdrop of this selling there are continuing strong general market indicators including:

Dear Friend/ Member,

Given the jump in the price of gold over this last weekend, it is worthy of an update as to what has been going on.

After steady rises for Gold the previous week, this week started off looking fairly stable range trading between USD$1,660 and USD$1,670.

By Thursday it was steady as she goes, as was reported by Reuters on the AusMint website.

http://www.ausmint.com/content/precious-gold-holds-steady-ahead-jackson-hole-symposium