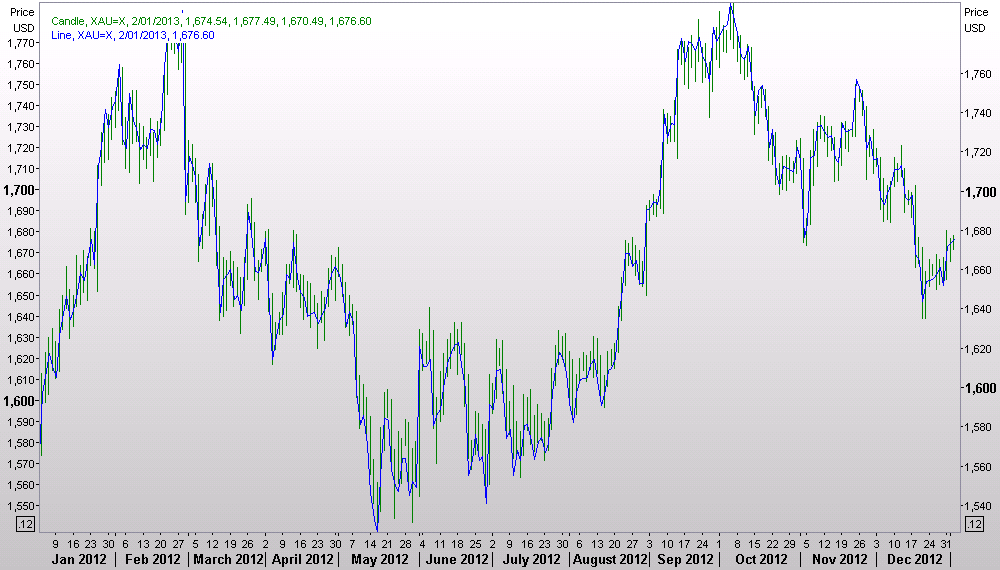

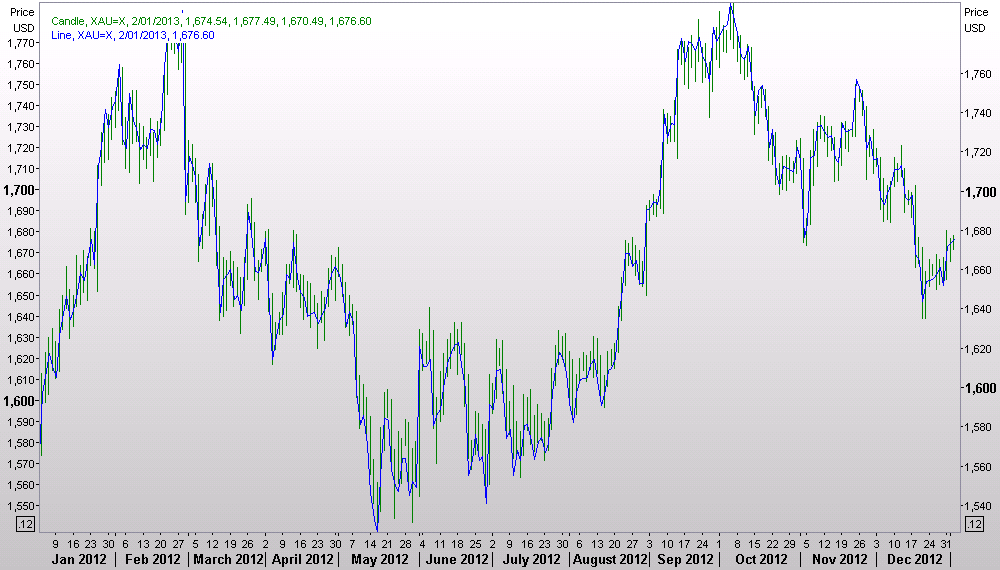

Gold has ended the year 5.2% up for the 2012 year in AUD terms (and 6.9% up in USD terms). Importantly Gold chalked up its 12th annual advance, the longest consecutive gain of any commodity.

2012 has been an up and down year, more down in the last 3 months end of year profit-taking and an uncertain period in relation to the US fiscal cliff. The following chart summarises the year:

Fiscal Cliff resolved?

The impact of the now infamous 'fiscal cliff', but perhaps more importantly an unbelievably pathetic display of governance by the Politicians in the USA, continues to weigh on financial markets. Although there has been much reported on the fiscal cliff here is a brief summary of the current state of play..

- After various attempts to get an agreement floundered, the Senate gained agreement to a half-hearted bill that dealt with the tax side of the fiscal divide, albeit two hours into the New Year.

- The Senate voted unanimously to keep most tax cuts intact except for individuals earning over $400,000 or couples earning over $450,000 per year.

- This compromise is expected to raise $620 billion over 10 years, a paltry sum given that projected deficits over the period are expected to be between $10-$15 trillion.

- The House of Representatives have now passed the bill by a respectable margin.

In effect the politicians have bought themselves another two months to sort out the broader challenge of how to reduce the huge deficit.

Some thoughts on 2013:

- The USA politicians will continue to flounder and struggle to gain a clear resolution in how to reduce spending, increase revenue and ultimately reduce the annual deficit.

- More money will be printed by the US government to fund its deficit that will likely once again be in the vicinity of $1 trillion.

- There will be little good economic news out of Europe.

- All of this reinforces the general notion, now evident practically worldwide that politicians are losing control of their monetary base.

- Interest rates in Australia are set to go lower.

Based on these considerations, Gold and other precious metals will likely be higher in the weeks ahead and continue in an overall upward trend to record a 13th consecutive year of gains.