A Gold Chart that tells an important story!

Found a very interesting article via one of our Partner websites;

www.kitco.com, that appeared over the weekend that I thought you might find

useful.

Of recent months we have seen considerable volatility around

the Gold & Silver prices but most of the talk has been about the

'Non-Physical' markets or Paper tradeable markets. But remember at the end of

the day the longer term perspective and prices will be all determined by

physical demand and supply........ an interesting read!

Shocking New Gold Chart:

Look at it now, before everyone else

gets ahold of it.

By Keith Fitz-Gerald, Chief Investment Strategist, Money Morning

What I'm about to say will challenge even the most steadfast gold bears

- or anyone for that matter right now who thinks that gold has seen its better

days.

The chart below tells a story - a big story. In fact, I encourage you to

forward this to anyone you know who is serious about their money.

What I found here, with the help of Frank Holmes from U.S. Global and one of

the smartest people on earth on the potent combination of Asian markets and

commodities, is a chart that shows a truly astounding fact about gold.

Let me walk you through it, and what it could mean to your money, your gold,

and your financial future.

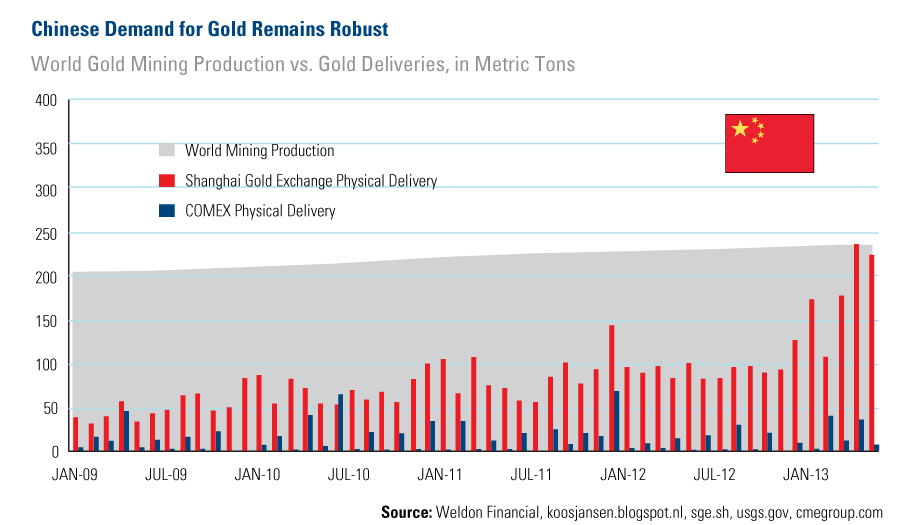

The grey backdrop is total world mining production. The blue vertical lines

represent COMEX gold deliveries. And the big long vertical red lines? That's

physical gold delivery on the Shanghai gold exchange.

The takeaway? - Chinese demand for physical delivery

all by itself is nearly equal to total worldwide gold production.

That's not a misprint.

In fact, so far this year Chinese deliveries through the Shanghai exchange

account for nearly 50% of total global production all by themselves. The COMEX

that's part of the New York Mercantile Exchange is almost an afterthought.

This is about as bullish as it gets because the basic laws of supply and demand

stipulate that whenever supply is reduced but demand remains constant or

accelerates, higher prices result.

No Stopping It

This is as immutable as the sun coming up tomorrow or the grass turning

green in the spring.

This is good for the markets in general, especially with Bernanke hell bent on

keeping the "bad is good theme alive" when it comes to further stimulus.

And this is positively great for gutsy gold investors at a time when others

want to relegate it to the scrap pile.

Imagine what happens when people actually figure out that China is buying so

much gold that physical deliveries there could account for 100% of worldwide

production by year's end?

For investors wanting to play gold, there are quite a few options.

But one's the best...

Get Ready For a 21st Century Gold Rush

Purists feel owning physical gold is the only true hedge against global

turmoil and declining values in the dollar and other fiat currencies.

For smaller investors, this typically means buying gold bullion bars, rounds

(unadorned coin-shaped pieces) or minted gold bullion coins.

Bullion bars - produced primarily by private mints like PAMP, Engelhard,

Johnson Matthey PLC (LON: JMAT) and Credit Suisse Group AC (NYSE ADR: CS) -

come in an assortment of sizes to suit the needs and means of every investor.

..............................................................

AusMint

supplies only the finest quality PHYSICAL Gold & Silver

AusMint's recommended product range of Gold & Silver

Bars and Coins come from PAMP.

Why AusMint?

Please call us at anytime if you wish to discuss any topic or questions you may have.

Check out our Charts at www.ausmint.com

DISCLAIMER: Australia Mint Bullion & Coin does not provide financial advice and does not employ financial advisors. Any opinions expressed within news articles or market updates are not intended as recommendations. If you are looking for investment advice, please seek independent, specific advice regarding your personal financial situation from a qualified professional.